- Soroco Tops Everest Group’s PEAK Matrix® Assessment - Four Years in a Row

Scout

Customer Stories

Ecosystem

Work Graph

Challenges

With operations in over 100 countries, one of the world’s largest insurance brokerage firms managed a significant motor insurance portfolio across Europe. While the portfolio spanned multiple regions, persistent operational challenges were concentrated in Madrid and Lisbon. The effort was led in collaboration with the regional claim’s leadership team, focused on improving efficiency and client service in these two markets. Following were the challenges they faced-

Due to lack of standardization, both insurance teams in Madrid and Lisbon were handling initial claim reports (FNOL) differently, leading to inconsistencies.

Limited data driven visibility into unified claims platform in Lisbon restricted the ability to further improve claims operations.

- Teams

FNOL Claims Creation

- Location

- Key runtime metrics

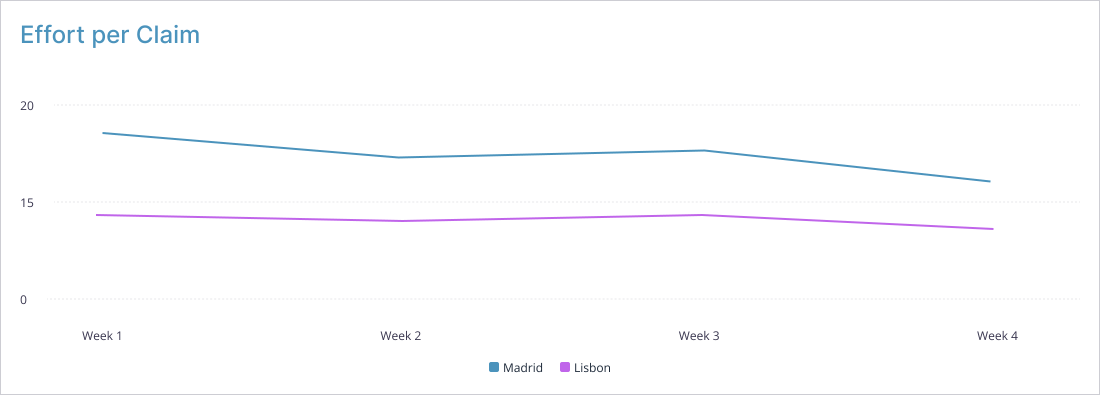

Effort per Claim

Enter Scout

Scout Insights

Effort variance

25% effort variance in effort per claim across locations was observed, with Lisbon demonstrating greater efficiency.

Off platform workload

10% effort in Lisbon was spent on handling policy coverage and client specific procedures outside the unified claims platform.

Runtime metrics

Recommendations

Standardize claim operations

Migrate Madrid’s LoB to the unified claims platform used by Lisbon to reduce effort per claim.

Platform scope expansion

Integrate policy coverage and client specific procedure into the unified claim platform to achieve 10% optimization potential.

Strategic Payoff

Scout identified a potential reduction of 25% in effort per claim and an additional optimization of 10% annually on Motor LoB across two locations by successfully improving platform adoption and reducing system fragmentation.