- Soroco Tops Everest Group’s PEAK Matrix® Assessment - Four Years in a Row

Scout

Customer Stories

Ecosystem

Work Graph

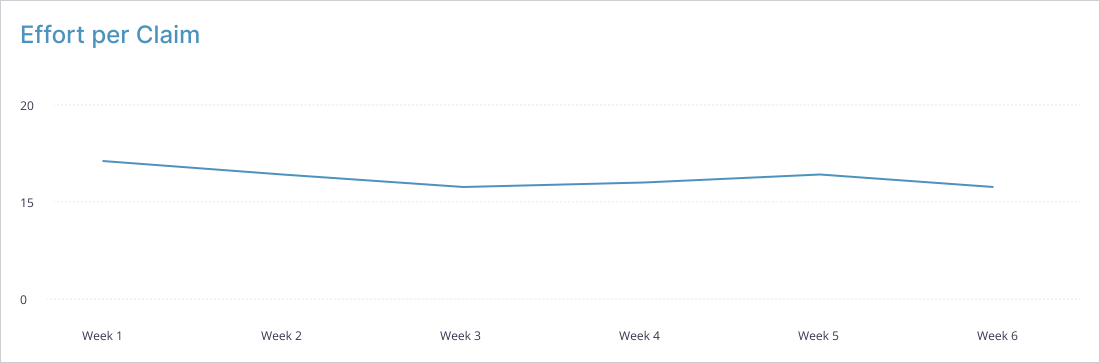

Scout identified a 15% potential effort per claim reduction for a leading insurance company, ensuring continuous improvement

Challenges

Despite a unified claims platform, teams struggled to track how first notice of loss (FNOL) activities were actually executed on the ground.

Much of the work was happening in spreadsheets, emails, and other offline tools — increasing operational overhead.

The lack of integration between platforms led to inconsistent processes, frequent context-switching, and difficulty in enforcing standards.

- Teams

- Location

- Key runtime metrics

Effort per Claim

Enter Scout

Scout Insights

Missing features

Policy coverage and client specific procedures were not integrated into the claim system leading to additional effort.

Unstructured communication

There was heavy reliance on excel, outlook, and emails for claims, payments, and FNOL processing which led to fragmented workflow & disconnected systems.

Runtime metrics

Recommendations

Integrated workflow management

Automate internal workflows integrated with client portal for seamless information exchanges.

Streamline claims tracking & train users

Leverage case management dashboards to replace manual tracking of claims and productivity metrics & train users to maximize existing email functionality for seamless claimant communication.

Strategic Payoff

Scout uncovered ~15% potential reduction in effort per claim by identifying repetitive, manual activities- enabling teams to streamline operations and focus on higher-value work. It also identified a potential improvement in response time by ~30%, thus ensuring seamless claimant experience.