- Soroco Tops Everest Group’s PEAK Matrix® Assessment - Four Years in a Row

Scout

Customer Stories

Ecosystem

Work Graph

Improving straight-through processing by 40% for a leading mortgage servicing company with Scout

The Challenge

A leading mortgage servicing company in the U.S., with 2 subsidiaries and more than 6,000 employees, faced critical challenges in its underwriting function.

Industry

Financial Services

Location

United States

6,000

Employees

2

Subsidiaries

Attempted Solution before Scout

About

1,000 hours

required from the business teams for discovery workshops

Enter

The Head of Process Excellence decided to implement Scout, to find and fix the firm’s challenges. Scout was deployed swiftly, integrating seamlessly without the need for complex adjustments to the existing systems.

Scout revealed crucial insights within the

first week

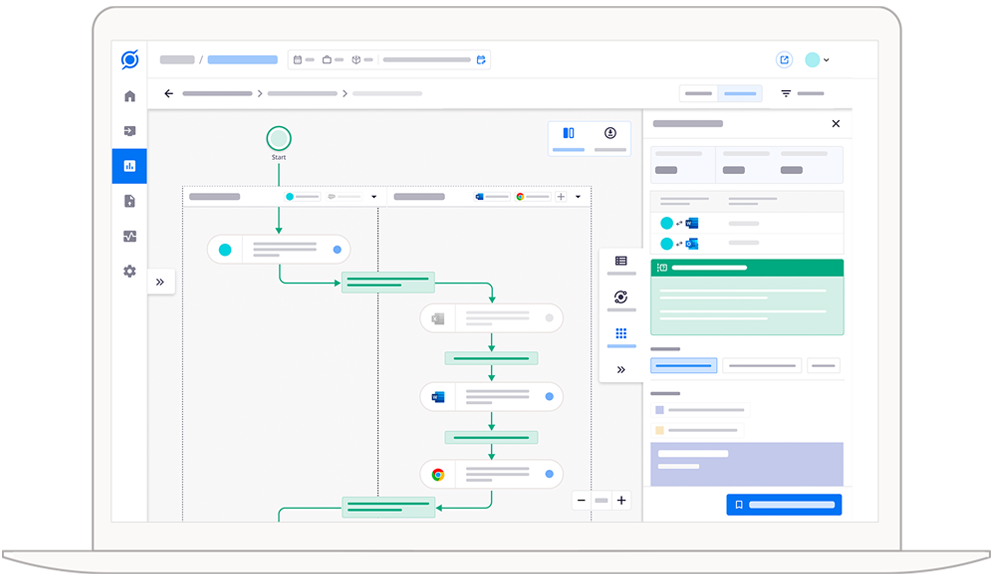

Scout’s AI to “find and fix”

Step 1: Find

Immediately after deployment, Scout revealed crucial insights within the first week:

Only 60% of the underwriters’ time was dedicated to core underwriting tasks.

The startling statistic that underwriters toggled between applications and documents 800-1,000 times a day, due to unintegrated systems and fragmented data, pointed to a massive work recall gap highlighting the disparity between the team’s understanding of how work is being done and how work was actually being done.

The analysis also found a heavy reliance on manual processes and “shadow IT” systems, like Excel spreadsheets, which were inefficient and time-consuming.

Step 2: Fix

Quick Fixes

Training sessions were conducted to elevate the entire team's performance to the level of the most experienced members

A central repository for

underwriting calculators and

templates was created

Deep Fixes

The leadership initiated a digital transformation initiative to design an end-to-end workflow system, reducing the disconnection debt by integrating disparate systems and streamlining processes. An intelligent underwriting assistant was also introduced, further enhancing productivity and accuracy.

Strategic Payoff

With Scout’s intervention, the mortgage firm achieved remarkable improvements:

40%

30%

15%

Key operating principles

Scout’s deployment was driven by principles that are essential to every success story:

Empathy at the Core:

It is important to note that in all of these recommendations, privacy was of the utmost importance – and no employee data was shared. Empathy was at the core of all recommendations and the focus was on addressing and improving the core issues i.e., getting teams to work together across functions, fixing disconnected systems, and simplifying and optimizing work processes.

Continuous Visibility and Improvement:

Scout was an integral part of this transformation, providing continuous visibility and enabling ongoing improvements.

How AI connects interaction data to business outcomes

The AI then provides data-based recommendations for the necessary interventions to address these challenges, paving the way for improved outcomes.

We call this lighting up the ‘dark side of the moon’.

Download this customer success story

See Scout in action.

Schedule your demo now!