- Join us for Soroco Illuminate – Mumbai 2025 on 15th May 2025

Customer Stories

Ecosystem

Work Graph

Scout transforms customer onboarding for a global investment bank by reducing operational cost by 30%

Transforming Customer Onboarding for a Global Investment Bank with Scout by reducing operational cost by 30%

The Challenge

Industry

Investment Banking

Location

US

Attempted Solution before Scout

200

dashboards

Enter

The Head of the Global Market Division introduced Scout to provide data-based, near real-time insights into the core business questions. Scout’s AI model could be quickly put into action because it didn’t need complicated integration with current systems.

It was able to measure this across three metrics:

Scout's AI Model

could be quickly put into action because it didn't need complicated integration with current systems.

Responsiveness

The speed at which the client receives a response.

Seamless experience

Assessed by the number of interactions needed per case.

Variations

Identified client-specific variations or ways in which clients were serviced.

Responsiveness

the speed at which the

client receives a response.

Seamless experience

assessed by the number of

interactions needed per case.

Variations

identified client-specific

variations or ways in which

clients were serviced.

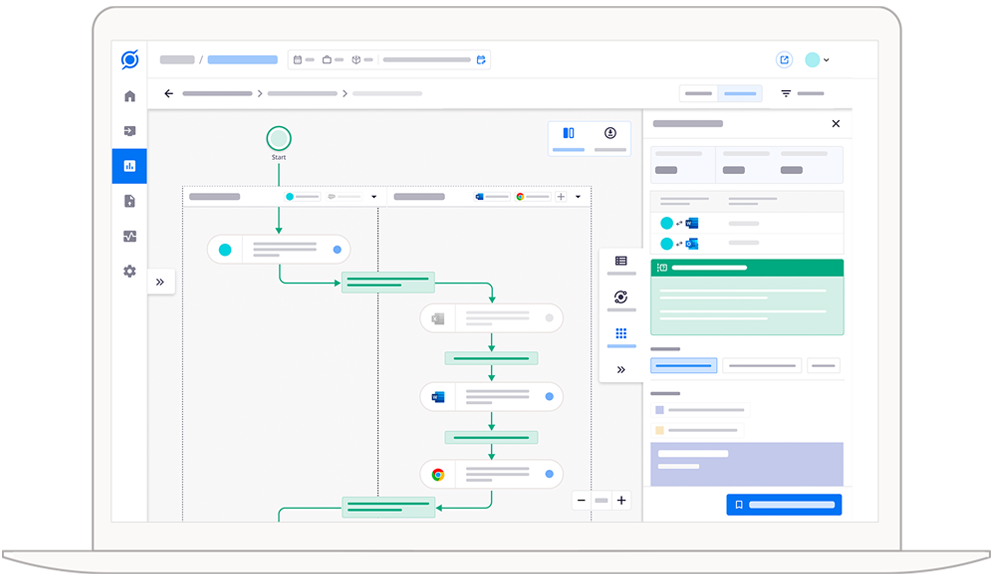

Scout’s AI to “find and fix”

Step 1: Find

- Identified specific pain points, such as the team's heavy reliance on MS Outlook and Excel.

- Uncovered an opportunity for email and process automation, which could boost efficiency by nearly 10% through toil reduction.

- Suggested automating data flow between external websites, spreadsheets, and Outlook, which could further enhance efficiency by 17%.

Step 2: Fix

Quick Fixes

Standardization of Data Inputs

The management team enforced standardization of data inputs across teams in the Customer Onboarding, Equity Essential Services/Trade (Buy & Sell), Security Settlement, and Prime Brokerage functions. This standardization enabled the generation of new metrics and insights.

This fix -

-

Reduced the total effort required to service clients

by the Global Market Operations teams and lowered

cost to serve per client. -

Allowed teams to focus on high-impact

activities, better align workforces, and deliver an improved,

seamless client experience.

Standardization of Reporting

Specific reports were developed using Scout data to provide a unified view of effort and touchpoints for each client service request. These reports tracked:

- Effort spent per client at various lifecycle stages.

- The number of follow-ups per client.

- The total effort expended across the entire service process.

This standardization allowed for a clearer understanding of resource allocation and client interactions at every stage.

Deep Fixes

Scout also provided detailed insights into the cost of unintegrated underwriting systems and applications, as well as the disconnection debt within the organisation.

Armed with these insights, the management team initiated a comprehensive transformation program to eliminate, automate, and transition low-impact workloads that delivered minimal value to both clients and the bank. This enabled more effective workload prioritization.

Additionally, the customer journey view in Salesforce CRM was enhanced by integrating Scout platform data. This integration provided Client Relationship Managers, Functional Leads, and Leadership with a single source of truth, offering visibility into key metrics and enabling them to monitor the impact of actions and interventions seamlessly.

It is important to note that in all of these recommendations, privacy was of the utmost importance – and no employee data was shared. Empathy was at the core of all recommendations and the focus was on addressing and improving the core issues i.e.

- Getting teams to work together across functions

- Fixing disconnected systems

- Simplifying and optimizing work processes

Business outcomes

In summary, Scout’s intervention led to significant improvements:

40%

Improvement in Turnaround Times:

For customer service and requests

30%

Reduction in Operational Costs: Streamlining

processes and eliminating inefficiencies

15%

Enhanced Revenue from Operations: Attributed

to increased trade volumes from large customers

Elimination of Low-Impact Workloads:

Enabling prioritization of high-value tasks

How Scout Lit up the “Dark Side of the Moon”

The AI then provides data-based recommendations for the necessary interventions to address these challenges, paving the way for improved outcomes.

We call this lighting up the ‘dark side of the moon’.

See Scout in action.

Schedule your demo now!