- Soroco Tops Everest PEAK Matrix® for Digital Interaction Intelligence 2024 - Third Year in a Row

Customer Stories

Ecosystem

Work Graph

Company

Transforming Customer Experience, and a 30% enhancement in NPS for Asia’s Largest Private Bank with Scout

The Challenge

Asia’s largest private retail bank, with over 8,000 branches and 150,000 employees, was at a crossroads. Faced with fierce competition from digital-first banks, it struggled with missed customer service level agreements (SLAs), high operating costs, and an outdated customer experience framework.

The bank handled nearly 10 million customer requests annually, with a significant portion—70% of customer instructions like address changes, contact updates, and new checkbook issuances—being processed manually through its extensive branch network. This not only strained the bank’s resources but also jeopardized its reputation for customer service excellence.

Industry

Retail and Corporate Banking

Location

APAC

150,000

Employees

8,000

Branches

Attempted Solution before Scout

Demanded approximately

3,000 hours

to conduct in-depth discovery workshops and interviews

Enter

In search of a more effective solution, the bank’s Head of Digital Strategy and Banking Operations decided to implement Scout, to find and fix this problem within their Central Processing team.

Within just

2 weeks

of deployment Scout's analysis unearthed several critical insights

Scout’s AI to “find and fix”

Step 1: Find

Scout’s analysis unearthed several critical insights within just two weeks of deployment:

A significant discovery was that 80% of branch requests were not related to debit cards, indicating a potential area for enhancing digital self-service options.

Another alarming issue was that 70% of the requests handled by the central processing unit were placed on hold due to incomplete or incorrect information from the branches.

The analysis also showed that the team spent about 30% of their time toggling between the core banking application and the document tracking system, leading to inefficiencies and delays. This startling statistic pointed to a massive work recall gap across the team, highlighting the disparity between the team’s understanding of how work is being done and how work was actually being done.

Step 2: Fix

Quick Fixes

Enhancements to the net banking and mobile app interfaces for non-debit card related services were rolled out

Increased marketing

efforts to promote digital channel usage

Enhancements to the net banking and mobile app interfaces for non-debit card related services were rolled out

Deep Fixes

The bank initiated a project to integrate the core banking system with the form tracking system, reducing the need for manual toggling and to reduce the disconnection debt. It also developed a combined cognitive automation and OCR-based solution for the service request workflow, significantly improving straight-through processing rates.

It is important to note that in all of these recommendations, privacy was of the utmost importance – and no employee data was shared. Empathy was at the core of all recommendations and the focus was on addressing and improving the core issues i.e.

- Getting teams to work together across functions

- Fixing disconnected systems

- Simplifying and optimizing work processes

Business outcomes

In summary, Scout was able to drive the following business outcomes

30%

20%

80%

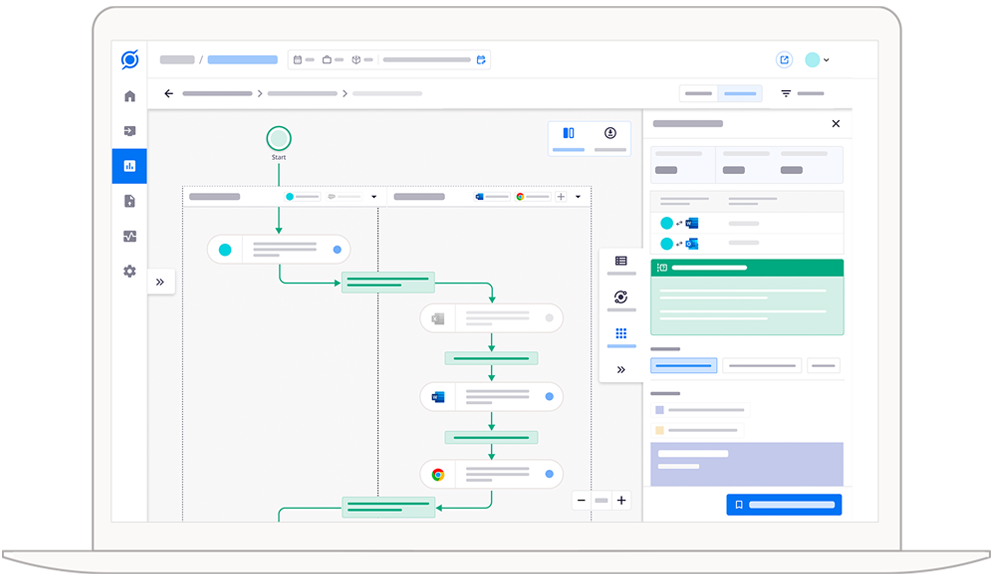

AI connects interaction data to business outcomes

Your business generates billions of data points from team-machine interactions. Scout, our AI model, deciphers this interaction data to reveal what often remains unseen—the hidden challenges your teams face at work and how they affect business outcomes, whether it's cost optimization, revenue growth, customer or employee experience, or business continuity.

The AI then provides data-based recommendations to address these challenges, paving the way for improved outcomes.

Download this customer success story

See Scout in action.

Schedule your demo now!