Customer Stories

Ecosystem

Work Graph

Company

Insurance

Scout reduced time to book new policies and increased underwriter productivity with higher straight through processing by 30%

The Challenge

A prominent Fortune 500 insurance company, with over 34,000 employees, was facing critical challenges in its underwriting functions. The issues included increased workload leading to errors and miscalculations, high customer dissatisfaction due to missed SLAs, and looming reputation risks that threatened significant revenue loss.

Industry

Insurance

34,000

Employees

Attempted Solution before Scout

The manual discovery process resulted in up to

40%

miscalculations

The company established an internal task force to identify automation and standardization opportunities. However, their manual discovery process, limited by a small sample size, failed to capture all workflows accurately, resulting in up to 40% miscalculations.

Enter

The EVP and Head of Operations introduced Scout to find and fix these challenges, and to gain a comprehensive understanding of the on-ground realities. Scout's AI model could be quickly put into action because it didn't need complicated integration with current systems.

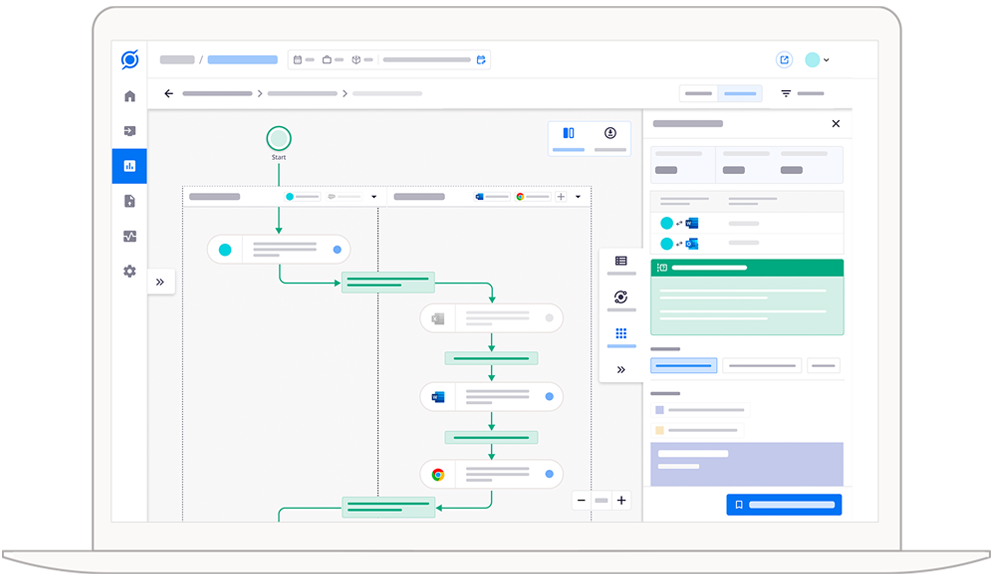

The AI analyzed how underwriting teams interact with various applications, including the core workbench underwriting application, mapping out how and why work happens the way it does within the underwriting team.

The AI analyzed how underwriting teams interact with various applications, including the core workbench underwriting application, mapping out how and why work happens the way it does within the underwriting team.

The AI decoded the work patterns by analyzing interactions between the underwriting team and their core workbench application

Scout to “find and fix”

Step 1: Find

As the first step, the AI decoded the work patterns of the underwriting team and connected them to business activities, by analyzing interactions between the underwriting team and their core workbench application. It then automatically classified these work patterns as either core underwriting activities or non-core activities.

Based on this analysis, within two weeks, Scout’s AI model provided the following insights:

Based on this analysis, within two weeks, Scout’s AI model provided the following insights:

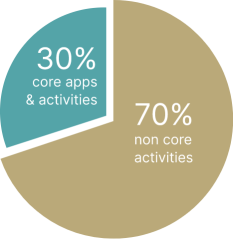

30%

of the team’s effort was spent on core underwriting workbench application and activities.

This startling statistic pointed to a massive work recall gap across the team, highlighting the disparity between the team’s understanding of how work is being done and how work was actually being done.

Scout’s AI model then further inferred the reason why the underwriting team spent so much time on non-core activities – information silos and disconnected systems.

These bottlenecks were forcing the team to incessantly toggle between 50+ applications and 100+ spreadsheets, ultimately resulting in a loss of productivity and context.

These bottlenecks were forcing the team to incessantly toggle between 50+ applications and 100+ spreadsheets, ultimately resulting in a loss of productivity and context.

Step 2: Fix

Based on the above insights, Scout’s AI model recommended two levels of fixes:

Quick Fixes

These were ‘no-code’ fixes based on standardisation and user training

Train the entire team to write instructions clearly using a defined template

The first initiative was to train the 100+ Underwriters on writing instructions clearly. This helped save ~15% of the team’s bandwidth which was blocked in Outlook and Teams conversations and ~500 application/context switches per team member per hour.

Creation of a document repository for underwriting calculators and templates:

There was an initiative to create a repository for all documents regarding underwriting rules, underwriting calculators and templates. This led to an immediate improvement in underwriting quality and helped free up approximately 7% of the bandwidth.

Within the first 4 weeks of implementing the above, the underwriting team gained 22% more time to focus on their core activity and on building robust relationships with agents, brokers, and customers.

Within the first 4 weeks of implementing the above, the underwriting team gained 22% more time to focus on their core activity and on building robust relationships with agents, brokers, and customers.

Deep Fixes

Systemic and long-term fixes planned across the organisation

Design an end-to-end workflow system:

Scout also provided detailed insights into the cost of unintegrated underwriting systems & applications and, also the disconnection debt in the organization.

With these insights and aiming to unify the experience across multiple applications and documents, the leadership kicked off a digital transformation initiative to create an end-to-end workflow system integrating information inputs, information validation, business process rules, transaction processing and reporting and compliance.

With these insights and aiming to unify the experience across multiple applications and documents, the leadership kicked off a digital transformation initiative to create an end-to-end workflow system integrating information inputs, information validation, business process rules, transaction processing and reporting and compliance.

This improved productivity by 30%

Deploy an Intelligent Underwriting Assistant:

The leadership also deployed an intelligent internal chatbot to assist underwriters, underwriting assistants and processors. This had integrations available with training repositories, policy specific rules and regulations as well as the capability to automatically trigger policy actions based on the roles accessing the system.

This helped improve underwriting quality, freed teams’ bandwidth by 20% and brought down the time to book a policy by 30%.

It is important to note that in all of these recommendations, privacy was of the utmost importance – and no employee data was shared. Empathy was at the core of all recommendations and the focus was on addressing and improving the core issues i.e.

- Getting teams to work together across functions

- Fixing disconnected system

- Simplifying and optimizing work processes

Business outcomes

In summary Scout was able to drive the following business outcomes

Significantly improve how employees experience work and improve their morale

33%

Reduction in Time to Book a New Policy

30%

Improvement in Underwriter Productivity

$3.75M

Estimated Annual Savings

How AI connects interaction data to business outcomes

Scout lights up the ‘dark side of the moon’.

Your business generates billions of data points from team-machine interactions. Scout, our AI model, deciphers this interaction data to reveal what often remains unseen—the hidden challenges your teams face at work and how they affect business outcomes, whether it's cost optimization, revenue growth, customer or employee experience, or business continuity.

The AI then provides data-based recommendations to address these challenges, paving the way for improved outcomes.

Your business generates billions of data points from team-machine interactions. Scout, our AI model, deciphers this interaction data to reveal what often remains unseen—the hidden challenges your teams face at work and how they affect business outcomes, whether it's cost optimization, revenue growth, customer or employee experience, or business continuity.

The AI then provides data-based recommendations to address these challenges, paving the way for improved outcomes.

See Scout in action.

Schedule your demo now!