Customer Stories

Ecosystem

Work Graph

Company

Telecom

A leading multinational telecommunications giant improved its payment collection rate by 35% with Scout.

The Challenge

A leading telecommunications giant was grappling with operational inefficiencies in its Collections GBS division. The team faced a daunting task: managing 260k cases of unsettled credit bills annually, leading to significant impacts on revenue recognition, cash flow, and key financial metrics.

The collections team had to constantly follow up with customers for payment and were often met with undesirable cases such as contact but no payment confirmation; voicemail, no response; redirected to 3rd parties.

They also had to deal with cases in which customers disputed the charges or requested payment extensions. The team was spending a chunk of their time researching and settling such cases.

As a result,

The collections team had to constantly follow up with customers for payment and were often met with undesirable cases such as contact but no payment confirmation; voicemail, no response; redirected to 3rd parties.

They also had to deal with cases in which customers disputed the charges or requested payment extensions. The team was spending a chunk of their time researching and settling such cases.

As a result,

- Mid-Management was unhappy as key business metrics such as Past Dues & Average Days Delinquent were impacted which was in turn affecting key financial metrics.

- Leadership was unhappy as Revenue Recognition; Cash flow and Revenue Forecasting were impacted since less than 25% of overdue payments were getting completed.

- Collections teams were dissatisfied as they could not meet their key performance targets such as Collections Settlement Rate, Positive Outcome Rate & Payment Realization Rate since their best attempts at collection were hampered by upstream issues and negative customer responses.

Industry

Telecom

Location

Europe

Attempted Solution before Scout

The consultants followed the traditional approach of interviewing subject matter experts which was a

manual effort:

time intensive

and subjective

The company engaged a top finance transformation consulting firm to optimize the Accounts Receivable process.

The consultants followed the traditional approach of interviewing subject matter experts (SMEs) from the Collections team, which was a manual effort, time intensive and subjective in nature.

Moreover, SMEs were already overstretched and had no time to answer detailed questions and provide extensive data which was needed by the consultants.

As a result, the leadership could not achieve their desired business outcomes and the problems persisted for leadership, management and collections team. This manual approach didn’t add any real value and intensified the problem.

The consultants followed the traditional approach of interviewing subject matter experts (SMEs) from the Collections team, which was a manual effort, time intensive and subjective in nature.

Moreover, SMEs were already overstretched and had no time to answer detailed questions and provide extensive data which was needed by the consultants.

As a result, the leadership could not achieve their desired business outcomes and the problems persisted for leadership, management and collections team. This manual approach didn’t add any real value and intensified the problem.

Enter

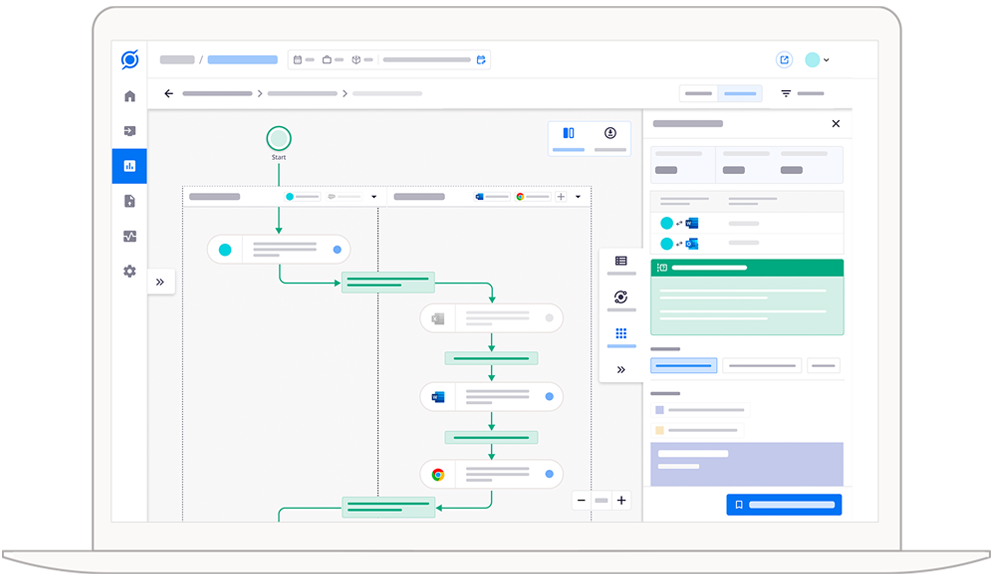

The CFO and Head of Digital Transformation turned to Scout to find and fix problems in their Account Receivable operations. Deployed within hours without needing complex integration, Scout focused on team-based insights while ensuring user anonymity and transparency.

Scout's AI model could be quickly put into action because it didn't need complicated integration with current systems. The AI analysed how collections teams interact financial accounting systems and other applications, mapping out how and why work happens the way it does within the collections function.

Scout's AI model could be quickly put into action because it didn't need complicated integration with current systems. The AI analysed how collections teams interact financial accounting systems and other applications, mapping out how and why work happens the way it does within the collections function.

Scout's AI model

decoded the

work patterns

of the collections team and connected them to business activities

Scout to “find and fix”

Step 1: Find

As the first step, the AI decoded the work patterns of the collections team and connected them to business activities, simply by analysing interactions between the team and their software. It then automatically classified these work patterns as either core account receivable activities or non-core activities.

Based on this analysis, within two weeks, Scout’s AI model provided the following insights:

Based on this analysis, within two weeks, Scout’s AI model provided the following insights:

60%

time was spent on core financial system

Scout's analysis revealed that only 60% of the Collections team's time was spent on the core financial system, the majority on low-priority cases like ‘no payment confirmation’, ‘voicemail’, ‘no response’, ‘redirected to 3rd parties’ and cases with upstream issues (ex. erroneous case creation, payments made but not reflecting in system) as there was no case categorization to identify and de-prioritize such cases. Hence, ~50% of cases they spent their time on, remained unsettled.

40%

time was spent on manual communications

The AI also determined that the remaining 40% of the time was wasted on manual communications, document handling, and toggling between applications.

This startling statistic pointed to a massive work recall gap across the team, highlighting the disparity between the team’s understanding of how work is being done and how work was actually being done

Step 2: Fix

Based on these insights, the management team devised a strategic action plan:

Quick Fixes

These were ‘no-code’ fixes based on standardisation and user training

Email Templatization

Email Templatization

Standardizing the content and format of frequent communication to streamline customer interactions.

Document Consolidation

Document Consolidation

Centralizing collections-related documents to reduce time spent on file searching and toggling.

Note Generator Application

Note Generator Application

Explore tools to save time on manual note-taking and documentation.

Deep Fixes

Systemic and long-term fixes planned across the organisation

Scout also provided detailed insights into the cost of unintegrated payroll systems and, also the disconnection debt in the organisation, leading to deep fixes across the function.

Common Case Management System

Common Case Management System

Implementing a system to log, categorize, and prioritize customer collections cases effectively.

RPA for Manual Validations

RPA for Manual Validations

Several customer validations, verifications and research in the dispute and payment extension processes could be automated to perform the manual activities by rule-based automation.

New Notification Channels

New Notification Channels

Introducing mobile app and text notifications to nudge customers towards timely payments and self-service options. All notifications to remind customers on overdue payments could be made through the Business App giving them the option to request a call back. Automated calls could be sent as reminders targeted at the group which has tendency to pay over call (e.g.DD/Payment Details provided)

Note Generator Application

First Contact via Business App

Encouraging customers to schedule callbacks, reducing the time spent on unsuccessful contact attempts. This also acts as a nudge for the customer towards self-serve (via Business App) by providing incentives associated with reduction in late payment fees

It is important to note that in all of these recommendations, privacy was of the utmost importance – and no employee data was shared. Empathy was at the core of all recommendations and the focus was on addressing and improving the core issues i.e.

- Getting teams to work together across functions

- Fixing disconnected system

- Simplifying and optimizing work processes

Business outcomes

The strategic implementation of Scout's recommendations led to:

The implementation of Scout's recommendations led to enhanced cashflow and higher revenue recognition.

60%

Bandwidth Freed: New app features and case management systems significantly reduced the team's workload.

35%

Improvement in Payment Collections Rate: Directly impacting the team's morale and performance.

20%

Effort Savings: Through email and document templatization.

10%

Reduction in Past Dues: Within just a quarter, demonstrating a swift impact on financial health.

10%

Reduction in Toggling Effort:Achieved by consolidating information and documents.

How Scout Lit up the “Dark Side of the Moon”

Your business generates billions of data points from human-machine interactions. Scout, our AI model, deciphers this interaction data to unveil what often remains unseen—the hidden challenges your teams face at work and how they affect business outcomes, whether it's cost optimization, revenue growth, customer or employee experience, or business continuity.

The AI then provides data-based recommendations for the necessary interventions to address these challenges, paving the way for improved outcomes.

We call this lighting up the ‘dark side of the moon’.

The AI then provides data-based recommendations for the necessary interventions to address these challenges, paving the way for improved outcomes.

We call this lighting up the ‘dark side of the moon’.

See Scout in action.

Schedule your demo now!