AI to raise the bottom-line!

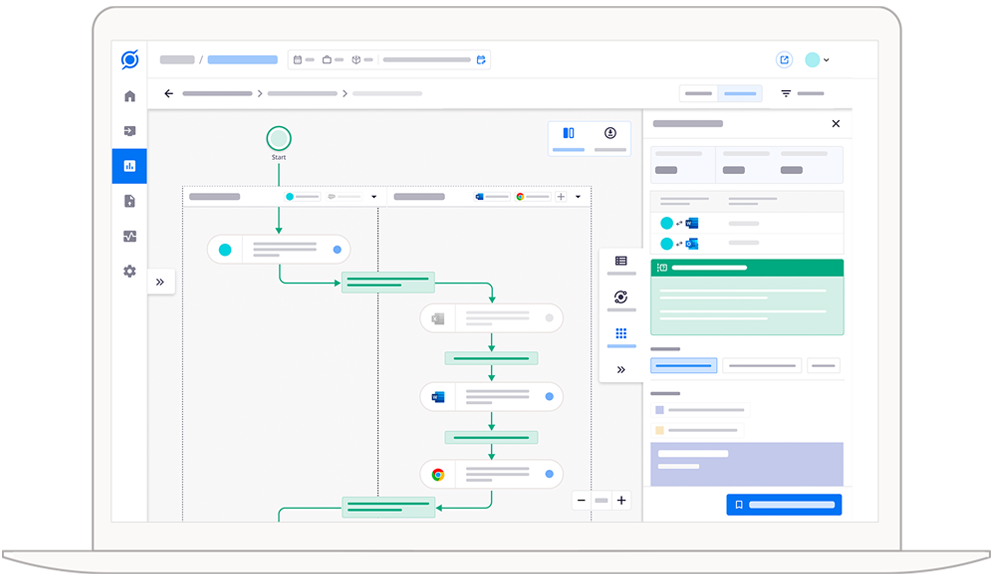

Cut handling times, reduce manual effort, and boost efficiency with the Scout AI model.

The Challenge: Inefficiencies in Vendor

Statement Reconciliation.

The Challenge: Inefficiencies in Vendor Statement Reconciliation.

Processing high volumes of vendor statements is slow and labor-intensive due to manual interventions.

Lack of a standardized template complicates data cleaning and delays the reconciliation process.

The Scout Solution: Optimize Every Step.

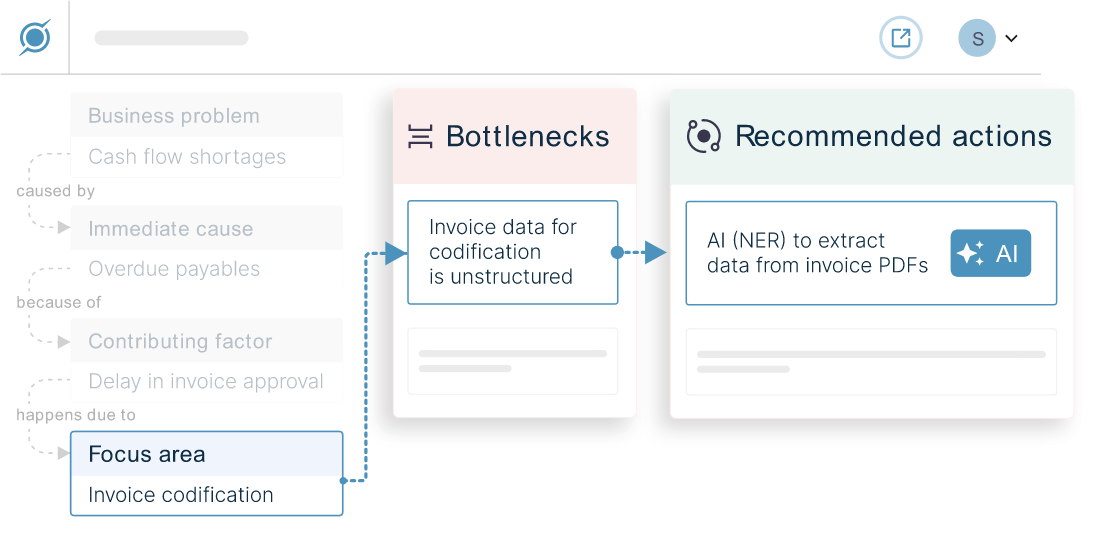

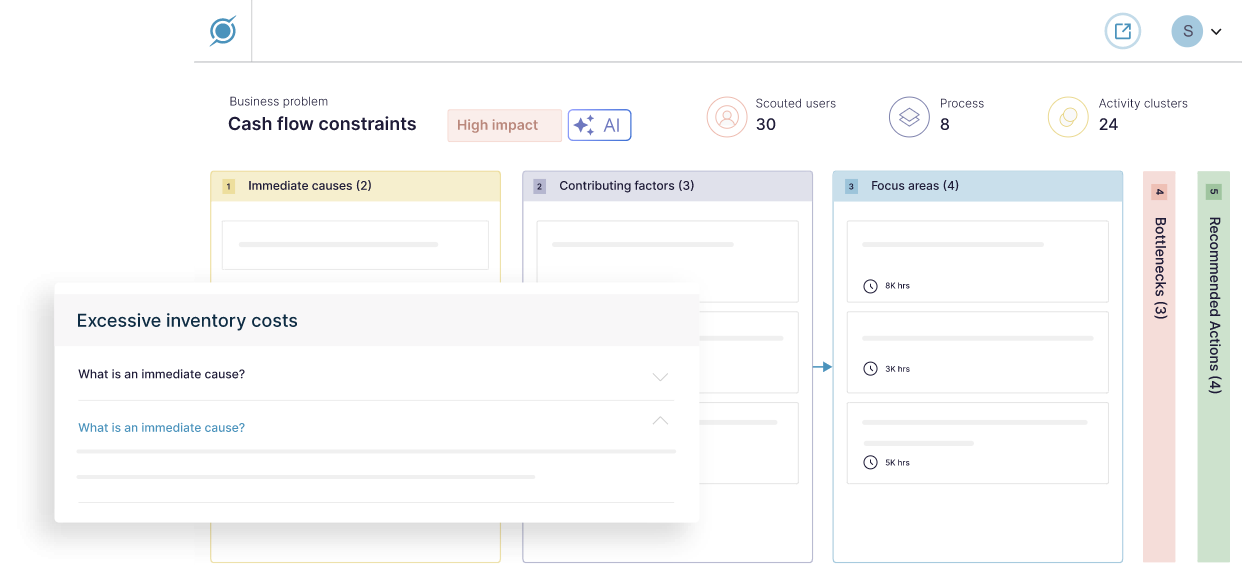

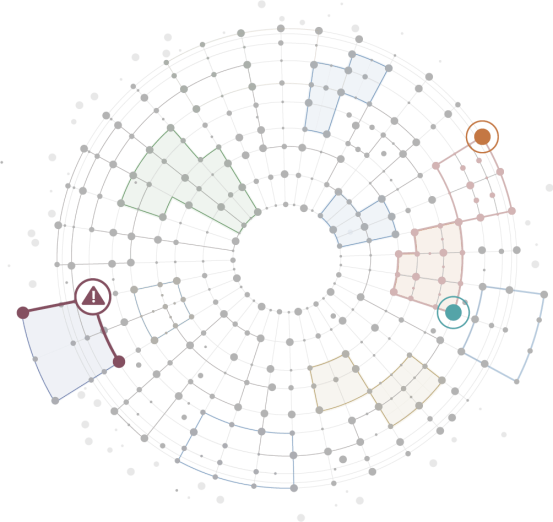

Uncover Bottlenecks

Automate & Save

Monitor Key Metrics

Boost Efficiency. Maximize Productivity.

F&A companies who have experienced the power of Scout

hidden-card-id

hidden-card-id

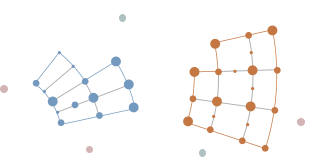

Scout creates a map of how teams across F&A experience digital work by capturing team-machine interactions. Scout’s AI model then analyses this interaction data to identify patterns and inefficiencies, generating a work graph.

This work graph helps finance teams optimize operational efficiency, manage risks, and enhance both customer and employee experiences, ultimately leading to improved business outcomes.

Excess manual effort

Common business activity

Leader in PEAK Matrix® Assessment: Digital Interaction Intelligence, 2024

Leader in NEAT Assessment: Process Understanding, 2024

Enterprise Innovator in HFS Horizons: Process Intelligence Products, 2023

Strong Performer in The Forrester Wave™: Process Intelligence Software, Q3 2023

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |